Wells Fargo Mobile Deposit

There is a limit of $2,500 per check deposited, and many businesses will have larger checks than this. Many other banks have a larger check limit for mobile deposit, and the fact that Wells Fargo does not is an inconvenience as it becomes necessary to visit a bank branch. This limit cannot be lifted even upon a request to customer service. Wells Fargo has been and continues to be a leader in enabling seamless payments and mobile-banking experiences, and this ruling has no impact on our customers’ ability to remotely deposit checks or the company’s work to provide innovative tools and technologies to our customers.”. For example, the Wells Fargo mobile app shows you your mobile deposit limit after you select a deposit account and enter the deposit amount. Your limit might be raised if your account has been open for several years without a problem, and you can try asking to have it increased. An in-person deposit with the bank teller lets you instantly access your newly deposited funds. Alternatively, although depositing your check at an ATM or via the mobile app may save you a trip to the bank, this may trigger extra wait time before the bank processes the check and makes the funds available to you.

How mobile deposit works

Explore these simple steps to deposit checks in minutes.

1. Download the Wells Fargo Mobile app to your smartphone or tablet.

2. Sign on to your account.

3. Select Deposit in the bottom bar. Or, use the Deposit Checks shortcut.

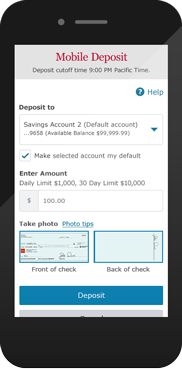

1. Select an account from the Deposit to dropdown. If you have set up a default account, it will already be pre-selected.

2. If you want to create or change your default account, go to the Deposit to dropdown and select the account you want to make your default, then select Make this account my default.

1. Enter the check amount. Your account’s remaining daily and 30-day mobile deposit limit will also display on the screen.

2. Make sure the amount entered matches the amount on your check, and select Continue.

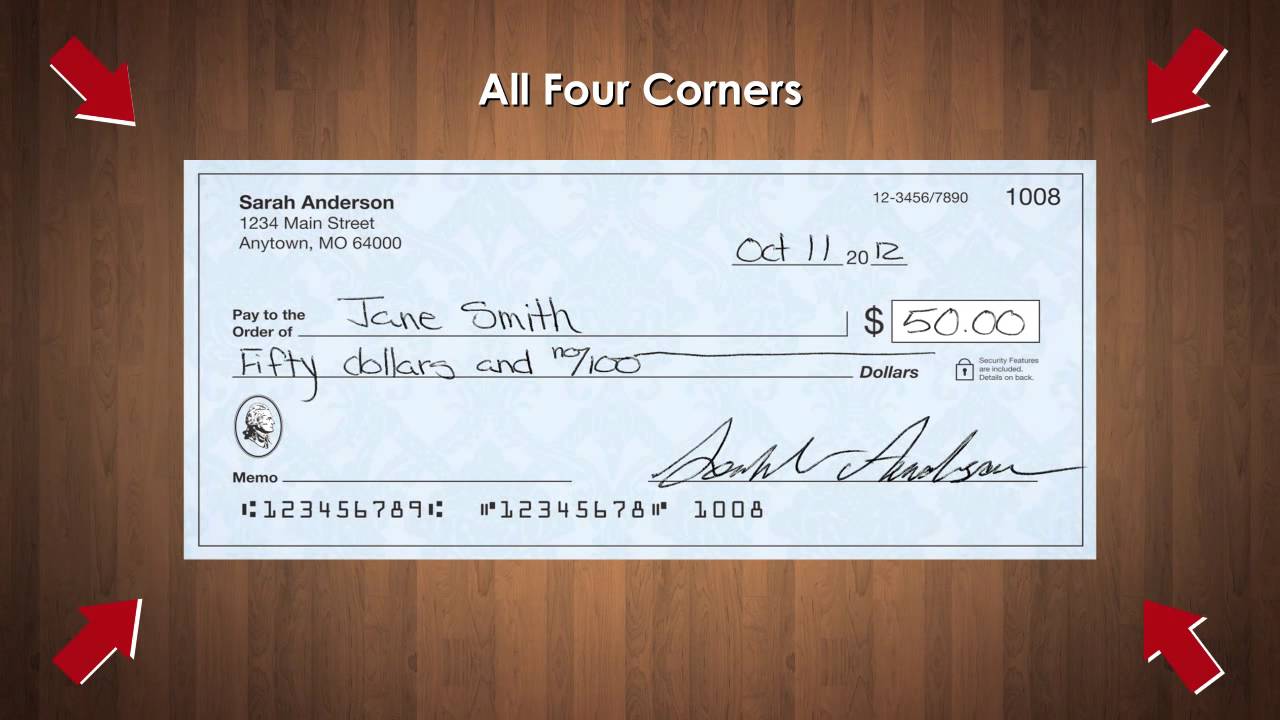

1. Sign the back of your check and write “For Mobile Deposit at Wells Fargo Bank Only” below your signature (or if available, check the box that reads: “Check here if mobile deposit”).

2. Take a photo of the front and back of your endorsed check. You can use the camera button to take the photo. For best results, use these photo tips:

• Place check on a dark-colored, plain surface that’s well lit.

• Position camera directly over the check (not angled).

• Fit all 4 corners inside the guides on your mobile device’s screen.

1. Make sure your deposit information is correct, then select Deposit.

2. You’ll get an on-screen confirmation and an email letting you know we’ve received your deposit.

3. After your deposit, write “mobile deposit” and the date on the front of the check. You should keep the check secure for 5 days before tearing it up.

Still have questions?

Quick Help

Call Us

Find a Location

Wells Fargo Mobile Deposit Maximum Amount

Mobile deposit is only available through the Wells Fargo Mobile® app. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement for other terms, conditions, and limitations.

Wells Fargo Mobile Deposit Limit

LRC-0620