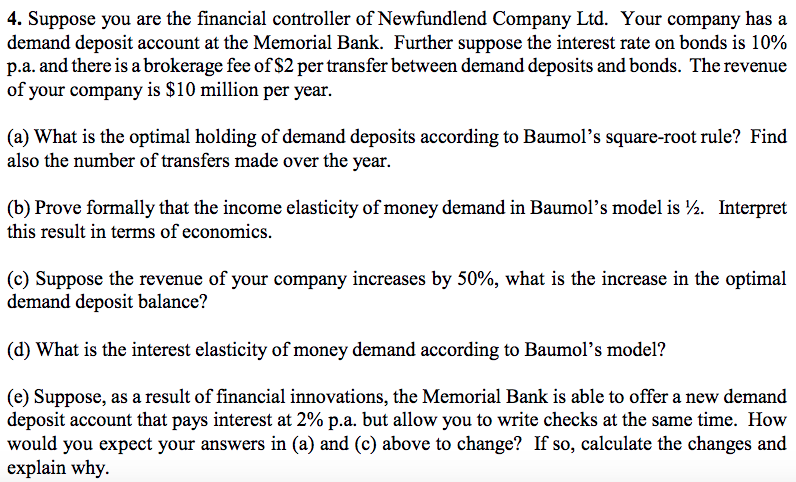

Demand Deposit Account

A checking account. One may demand payment of the money on deposit without penalty. Contrast with a certificate of deposit, in which one must pay a penalty if the money is withdrawn early. The Complete Real Estate Encyclopedia by Denise L. William Evans, JD. Demand Deposit Account. We know commitment is hard. With our Demand Deposit Account, you’re free to withdraw from your savings account whenever you like. Free your savings. Access your savings at any time from any permanent tsb ATM. Save as much or as little money as you like. Lodge your funds at any time. Withdraw your savings at any time.

DDA is a term usually used in finance that is an abbreviation for “Demand Deposit Account”. This is a type of a checking account where the account holder can withdraw their funds “on demand”, or anytime. Oftentimes, employers like to use these types of accounts to deposit their employees’ salary.

DDA Debit Charge

In this case, DDA means “Direct Debit Authorization“. This term is usually used in USAA bank accounts.

The DDA Debit Charge is sometimes referred to as DDA Purchase or DDA Pur. It is the status of a charge that is still “pending” on your account. Once the transaction fully goes through, the name will be updated to reflect the actual charge.

It is best to check if you have any automatic payments set for that specific amount, because in most cases, it is a pre-approved transaction that is still processing.

How Demand Deposit Account Differs from Other Bank Account Types

Some individuals would go to the bank and open up a Money Market Account. This other type of bank account cannot be withdrawn whenever you want. A DDA, on the other hand, is always available for withdrawal at any time.

- A Demand Deposit Account has lesser interest compared to other types of bank accounts.

- If you are depositing to a bank and you think you might need it in the near future, tell your bank to open a DDA.

- DDAs can be accessed using checks, debit cards, and other electronic methods.

What is DDA Credit?

Sometimes, accounts would have a negative balance or a lot of overdraft transactions. This occurrence is called DDA credit and often results to the account being closed. Most banks would automatically close accounts with DDA Credits when the negative balance is not settled within 30 days.

Time Deposit Account

Some terms to take note of:

- Overdraft – When an account has greater amount of withdrawals than what was actually deposited

- Charge off – When the bank assumes that the debt or overdraft cannot be collected or paid

Foreign Currency Accounts

The same concepts as above apply if you withdraw or deposit money with a forex broker. The charge is initially displayed as a DDA charge, and then it should be updated to include the appropriate broker name.

When individuals begin to learn of the many advantages of offshore or international banking, it is natural to want to establish a personal account and begin reaping the benefits. However, the wide range of account types can sometimes be overwhelming, leading people to select accounts that aren’t suited to their lifestyles or their financial needs. Often, a demand deposit account is the perfect fit.

Demand Deposit Account Meaning

To determine this for yourself, learn more about what a demand deposit account is, how it can be used and how it has the potential to benefit account holders.

What is a Demand Deposit Account?

In the most basic definition, a demand deposit account is just as the name suggests: An account where you can demand to withdraw any amount instantly. In a lot of ways, a demand deposit account is just like a checking account. You deposit money into the account periodically, and then you withdraw amounts when you need access to it.

However, there are some variations differentiating a demand deposit account from a checking account. To start, both accounts may have limitation on how quickly money can be withdrawn. When you write a check, for example, it could take a few business days to clear.

Another name for a demand deposit account is a NOW account, which speaks to the immediate nature and urgency of this particular type of banking account.

How To Use a Demand Deposit Account

A demand deposit account works as a vehicle for your deposits. These deposits can be automatic transfers from your place of work, or they could be checks from employers, vendors or family members. Whether the deposit is physical cash, a check or an electronic transfer, the money will go straight to the balance of your demand deposit account. Similarly, you can access the balance in a number of ways. If the account is connected to a debit or credit card, you can shop and spend as normal.

Alternatively, you can write and cash checks, pay bills online or make online transfers. Clearly, having online banking services in conjunction with a demand deposit account will increase its value and utility in a number of ways.

Benefits of a Demand Deposit Account

The primary benefit of a demand deposit account is that your assets held within it are available on demand. There is typically no waiting period to access your money, or the waiting period is very short and just a couple of days.

Having immediate access to your liquid assets can give you peace of mind that if you ever need money, it is ready and available for you at a moment’s notice.

Define Demand Deposit Account

Ideal Candidates for a Demand Deposit Account

Demand Deposit Account Meaning

So many different types of people can benefit from a demand deposit account. If you ever write checks, or you’re just beginning to explore the potential of diversification with an offshore bank account, then a demand deposit account is ideal.

If you travel abroad often, or you’re planning to buy a second home overseas, then a demand deposit account can come in handy more than any other banking option.

Once you learn more about the demand deposit account, it becomes obvious that it is a smart, popular choice for investors, retirees and small business owners around the world.